Before you start looking for your first home, we can help you with a mortgage preapproval.

Simply fill out an application and my team will begin working diligently on your file to figure out your preapproval options. With a preapproval letter in hand you will feel confident in knowing that the likelihood of you getting approved when your file goes through underwriting is very good. Some realtors require buyers to get preapproved before even starting to house hunt. A preapproval letter can help you narrow your search to find exactly the home that matches your financial situation. It makes the mortgage application process that much smoother. And lastly, it shows home sellers that your financials are intact and therefore they can feel at ease with accepting your offer.

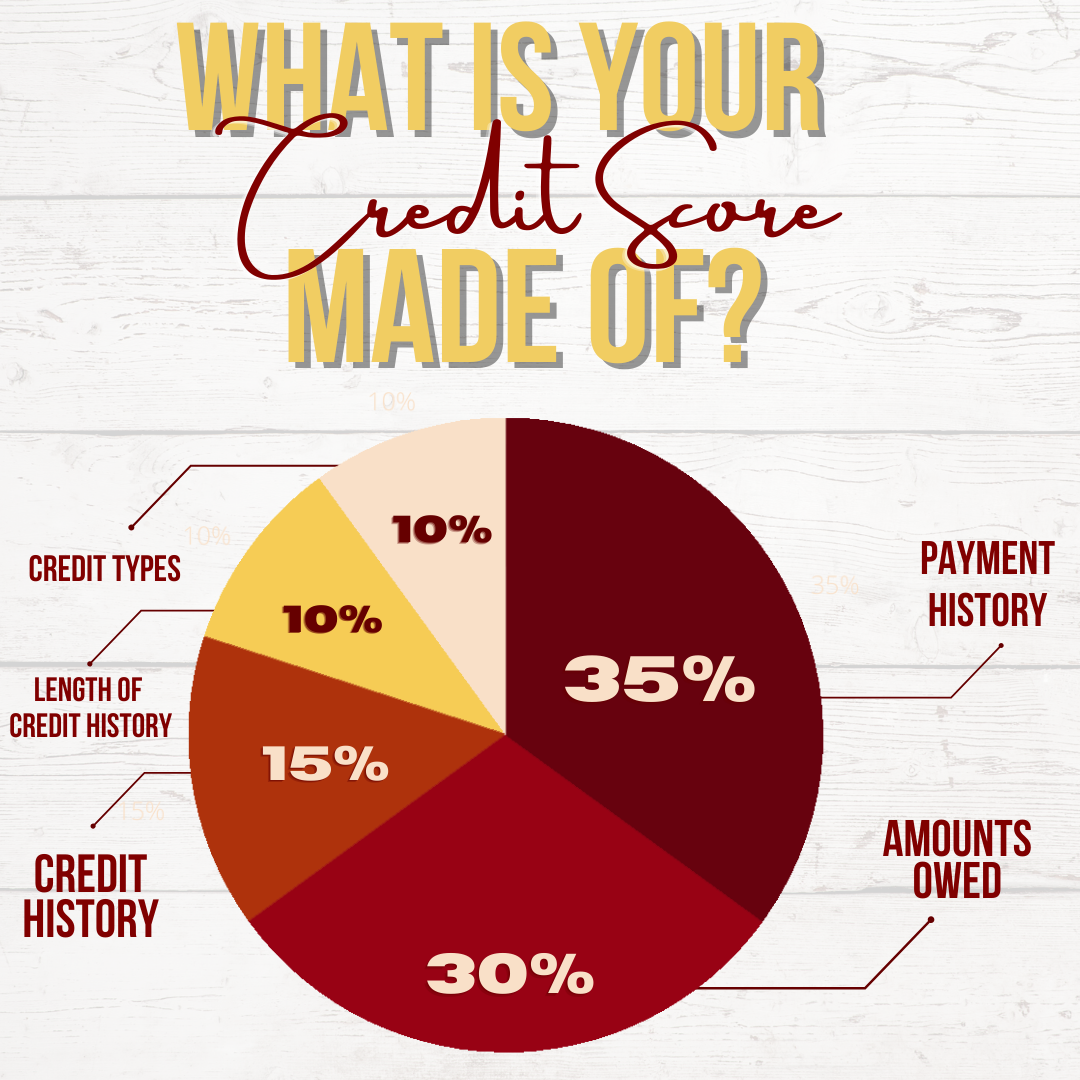

Determine how your credit looks.

Lenders will look at your payment history, income, and current debts to determine how likely you are to pay your loan each month. The number value assigned to your “reliability” is known as your credit score and is one of the biggest factors in getting approved for a mortgage.

There are many websites that allow you to quickly check your credit & credit score for free. Two of our favorites are www.freecreditreport.com and www.creditkarma.com but please make note that these sites are just to estimate where your scores will fall, they are not 100% accurate in determining your true mortgage FICO score.

If you have a credit score below 640, consider delving deeper into your report to make sure it is accurate. Stay current with all monthly payments and reduce debt where possible to boost your score.

Talk to my team at Benchmark Mortgage about your financial history, goals, and the path to buy a home.